Some Ideas on Personal Loans Canada You Need To Know

Some Ideas on Personal Loans Canada You Need To Know

Blog Article

The Facts About Personal Loans Canada Revealed

Table of ContentsThe smart Trick of Personal Loans Canada That Nobody is DiscussingPersonal Loans Canada Can Be Fun For EveryoneThe Greatest Guide To Personal Loans CanadaThe Single Strategy To Use For Personal Loans CanadaAbout Personal Loans Canada

This implies you have actually provided each and every single dollar a task to do. putting you back in the motorist's seat of your financeswhere you belong. Doing a routine budget plan will offer you the confidence you require to handle your money efficiently. Good ideas come to those who wait.Conserving up for the large points means you're not going right into financial obligation for them. And you aren't paying much more in the long run as a result of all that interest. Trust fund us, you'll enjoy that family members cruise ship or play ground set for the children way a lot more knowing it's already paid for (rather of making payments on them till they're off to college).

Nothing beats tranquility of mind (without financial obligation of training course)! You don't have to transform to individual fundings and financial obligation when points obtain tight. You can be totally free of financial obligation and start making real traction with your money.

An individual finance is not a line of credit rating, as in, it is not rotating funding. When you're authorized for an individual car loan, your loan provider offers you the complete quantity all at when and then, normally, within a month, you begin repayment.

The Of Personal Loans Canada

Some banks placed specifications on what you can utilize the funds for, however lots of do not (they'll still ask on the application).

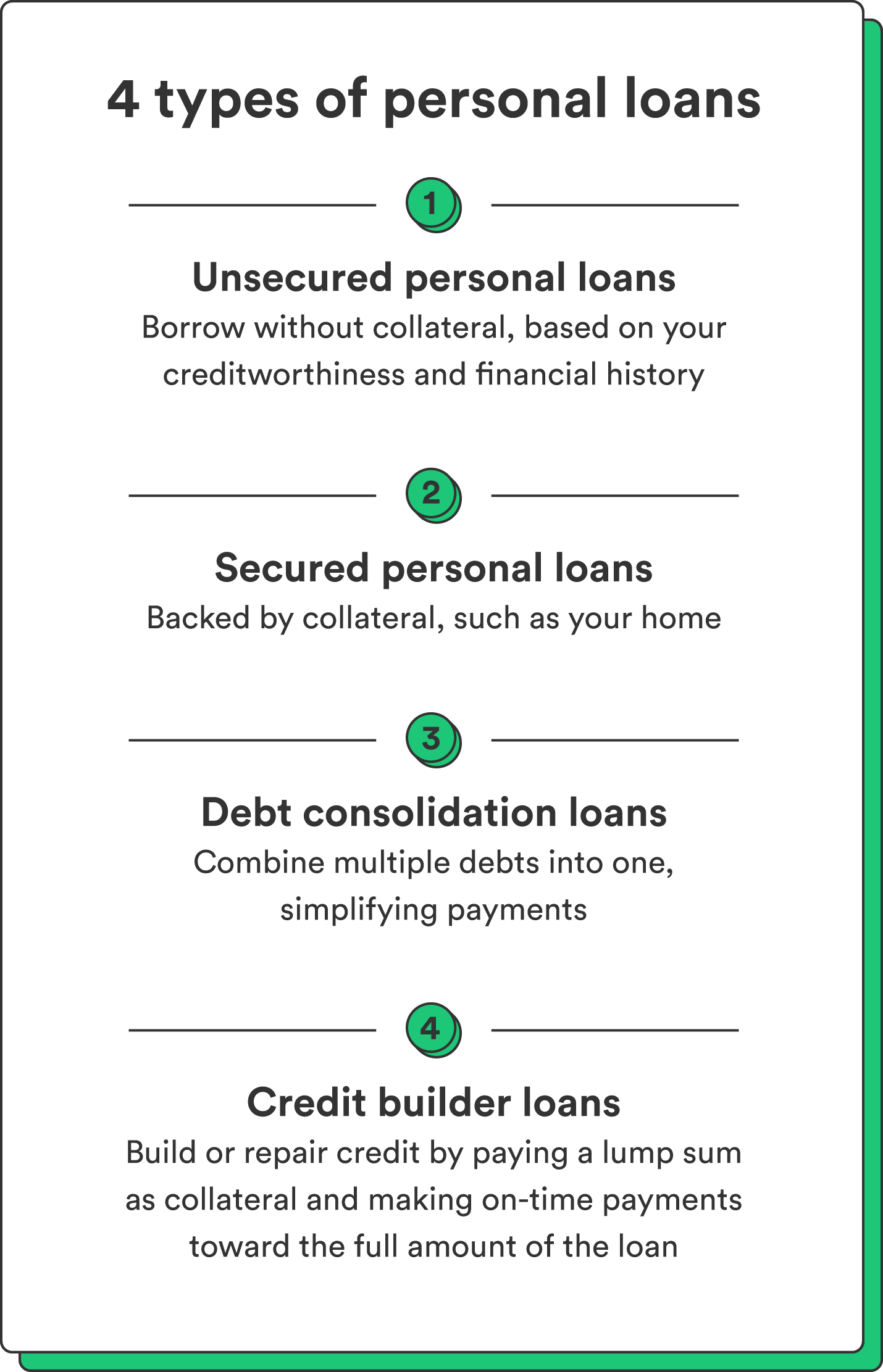

The demand for individual loans is rising among Canadians interested in escaping the cycle of cash advance lendings, settling their financial obligation, and reconstructing their credit rating rating. If you're using for an individual financing, below are some things you need to maintain in mind.

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

The Basic Principles Of Personal Loans Canada

Furthermore, you might be able to decrease just how much complete passion you pay, which implies even more cash can be conserved. Individual lendings are effective tools for developing your credit history. Payment history accounts for 35% of your credit rating, so the longer you make normal payments in a timely manner the more you will certainly see your score boost.

Personal finances provide a terrific opportunity for you to reconstruct your debt and check that pay off debt, yet if you do not budget plan properly, you can dig on your own right into an also deeper hole. Missing out on one of your monthly settlements can have an unfavorable result on your credit rating yet missing a number of can be ravaging.

Be prepared to make each and every single payment promptly. It holds true that a personal loan can be used for anything and it's easier to get approved than it ever before was in the past. Yet if you don't have an urgent demand the added useful content money, it may not be the most effective service for you.

The taken care of regular monthly repayment quantity on a personal lending relies on how much you're borrowing, the rates of interest, and the fixed term. Personal Loans Canada. Your passion price will certainly depend upon aspects like your credit report and revenue. Many times, personal lending rates are a great deal lower than bank card, yet sometimes they can be higher

What Does Personal Loans Canada Do?

Advantages include fantastic rate of interest rates, exceptionally fast processing and funding times & the privacy you might want. Not every person suches as strolling right into a financial institution click over here to ask for cash, so if this is a difficult area for you, or you just don't have time, looking at on-line lending institutions like Spring is a great alternative.

Repayment lengths for personal car loans typically fall within 9, 12, 24, 36, 48, or 60 months (Personal Loans Canada). Shorter repayment times have very high month-to-month settlements but after that it's over rapidly and you don't shed even more cash to interest.

Everything about Personal Loans Canada

Your passion rate can be linked to your settlement period. You could obtain a lower rates of interest if you fund the lending over a shorter period. A personal term financing features a set payment routine and a dealt with or drifting rate of interest. With a floating interest price, the interest amount you pay will vary month to month based upon market changes.

Report this page